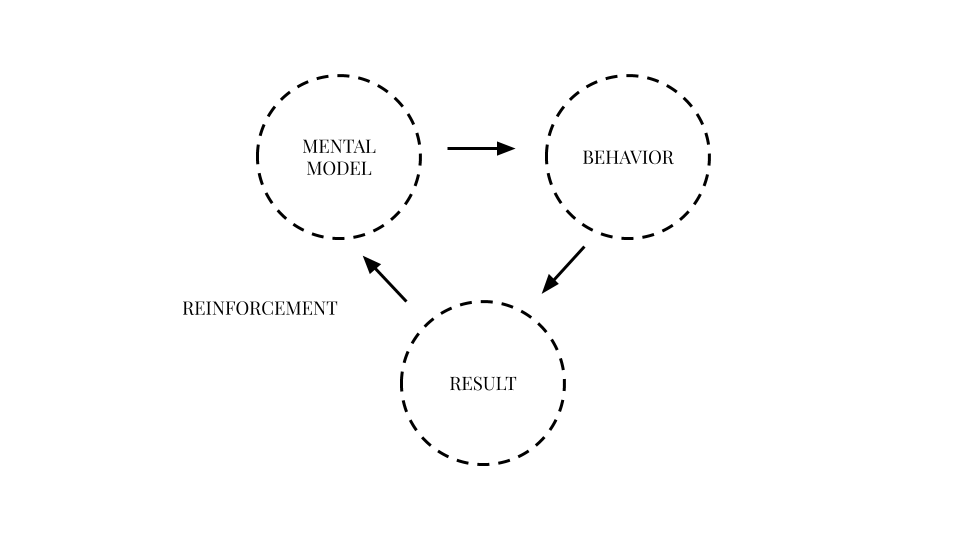

We see the world the way we are and mental models are my cheat sheet.

Mental models are a way we can understand the world because they shape the way we think and the connections and opportunities we see.

The phrase “mental model” is an overarching term for any sort of concept, framework, or worldview that you carry around in your mind. Mental models help you understand life.

On your journey as an investor, there are a few things you need to hold to be successful.

13 Investing Mental Model I Think Every Investor Should Master

1. Start small, scale up

You’ll need to start from where you are to get to where you want to be.

Your investing goals might seem larger than life but you’ll never get anywhere if you don’t start.

2. Your income is key

The more you earn, the more you can invest.

The amount of money you put to work over time affects how much profit you will make.

Even if your assets return 100% every year, you can only make so much investing £100/month over x number of years.

I really can’t stress this enough, you’ll need to make a plan on how to increase your income year on year.

3. Understand your risk profile

A risk profile is an evaluation of your willingness and ability to take risks.

By understanding this, you’re able to appropriately determine the proper investment asset that will help you meet your goals.

The higher the risk, the higher your possible returns. With this comes a higher chance of losing money too.

4. Do your due diligence and stay learning

Before you invest, you have to do proper due diligence and research to make sure the asset is worthwhile.

It is a detailed investigation of the asset you wish to invest in be it a stock (business), index fund, property etc. It provides verification and reassurance of the asset you are considering purchasing or investing in.

Essentially, undergoing due diligence is like doing “homework” on a potential deal and is essential to informed investment decisions.

5. Stay connected to your goals

Your goals will often inform how much you wish to make at the end of the journey, what sort of assets you can use and how much money to put in per time.

Your goals also keep you grounded when the market starts to fluctuate or when life happens and you’re tempted to sell your investments or stop investing entirely.

6. Automate. Automate. Automate.

After you have selected the asset(s) you want to invest in, you should automate a certain amount of your income every week or month to it.

This takes away the worry of forgetting to invest. Most platforms offer this feature.

You should have also automated recurring expenses like bills et al at this point.

7. Understand the Economy

Good investors have a good understanding of the economy because investing is basically about “predicting” the future.

What trends will continue to be relevant? What companies are currently solving consumer problems? Where will people continue to spend their money?

With this, you’ll be able to tell what (sectors, industries, companies etc) will possibly be profitable in the future and invest in corresponding assets.

8. Your baseline wealth should be in index funds

This is the hill I’m willing to die on.

The stock market is one of the asset classes available to you to build wealth. Investing in a stock is equal to investing in a business.

Index funds are like a basket full of multiple stocks. By investing in this, you’re diversified across multiple businesses and industries at once. This allows for less risk because the probability that all businesses will fail is almost zero.

Infact, if all businesses in an index fund (e.g QQQ which mirrors the top 100 tech companies in the America) fails; friend, you have more to worry about than your money.

Your baseline wealth should be in index funds because they’re less risky which helps you preserve your capital and can therefore form a solid foundation for you. As you make more money, you can then diversify into riskier assets like individual stocks, crypto, real estate etc.

I expand more on index funds in my investing for starters one on one workshop.

You can book here.

9. Diversify but not too much

Do not put all your eggs in one basket.

Yes, investing is a risk, but everything about life’s a risk so calm down!

To protect yourself, you’d have to position yourself properly across the different asset classes. This is called asset allocation.

But be warned, over diversification is a profit killer.

Over diversification cuts drastically into how much money you can make.

When you become enlightened, you’ll see that there are are many opportunities out there to build wealth but the bad news is, you only have so much money to put in per time.

Don’t get greedy and spread your moneys too thin.

If you invest £1000 across 5 assets and they make an average return of 15% per year, you make less money than when you put them in 3 assets with the same return.

Do the math!

P.S, this is why index funds were invented.

10. Be aware of taxes

The profits you make are subject to being taxed so make sure you invest in tax advantaged accounts like your ISAs.

In the UK, you can invest up to £20k in your ISA tax free. You can also invest up to £12,500 in a general investment account tax free. These are just a few of the ways you can avoid paying taxes on your investment.

11. Take advantage of government benefits

Some governments also provide a few benefits for its citizens, there’s no shame in taking advantage of them.

Example, in the UK, when you contribute to your LISA, the government adds 25% to your contributions.

Please note LISA contributions per year are a max of £4k.

12.Keep track of your investments with a spread sheet

You will need to allocate time every month or so to keep track of your investments. This is so you’re aware of how your investments are doing and you’re not blind sided.

By doing this, you can also spot opportunities.

In the early stages, when assets go down, you can even buy more because you’re buying at a discount.

13. Investing is a long term

Whatever asset you decide to invest in, you’ll need to hold on to it for at least 5 years. This is why it is advised to have a rainy day fund before investing so you’re not tempted to touch when emergencies arise.

Adopting a long term mindset will do you very well.

Conclusion

On your journey as an investor, you should make an effort to continue to learn as much as you can in order to be an intelligent and educated investor.

You don’t have to be Warren Buffet or my uncle, Charlie Munger to be successful.

You just have to be committed to learning, and very clear on what you are trying to accomplish.

Also, in this digital and content age, there is so much free advice on the internet about investment. One trick I use to stay updated is to follow investment content creators.

We spend so much time on social media, so following accounts that teach me with each new post is a way of making sure I receive value while I scroll through socials.

If you are interested in investing but don’t know where to start, check out my website or send me a message.